Entrepreneurship Series: Financing and Profitability -04

About Course

Start-ups can benefit from a wide variety of financing options on the path to profitability, but how do you know which one to choose? This course explores different financing models, including bootstrapping, organic growth, debt and risk capital, and also provides a clear overview of equity financing including the key types of investors: angels, venture capital, and crowdfunding. You’ll learn about terms, and term sheets, exit modes and what exit strategy might be best for you. By the end of this course, you’ll have an understanding of what success looks like and how it can be financed. You’ll also be ready for the capstone project, in which you will get feedback on your own pitch deck, and may even be selected to pitch to investors from venture capital firms.

Course Content

Week 1: Business Models and Keeping Customers

Introduction to Financing and Profitability

02:24Business Models

09:11Measuring and Managing CLV

26:55Greylock Partners: Joseph Ansanelli

14:47Lecture Slide PDFs

Week 2: Financing, Valuation and Terms

Week 3: Private and Public Financing and Calculating Breakeven

Elements of the Pitch & Exit Strategies

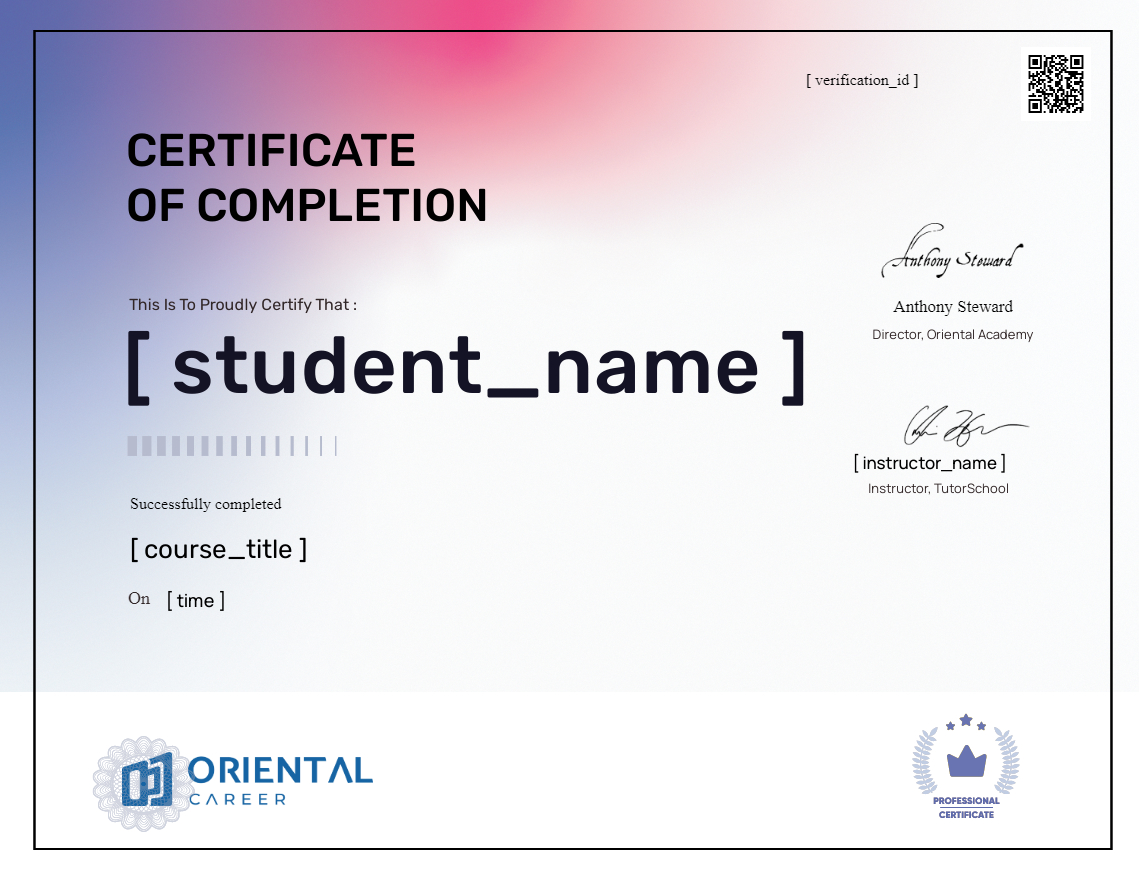

Earn a Certificate

Add this certificate to your resume to demonstrate your skills & increase your chances of getting noticed.

Student Ratings & Reviews